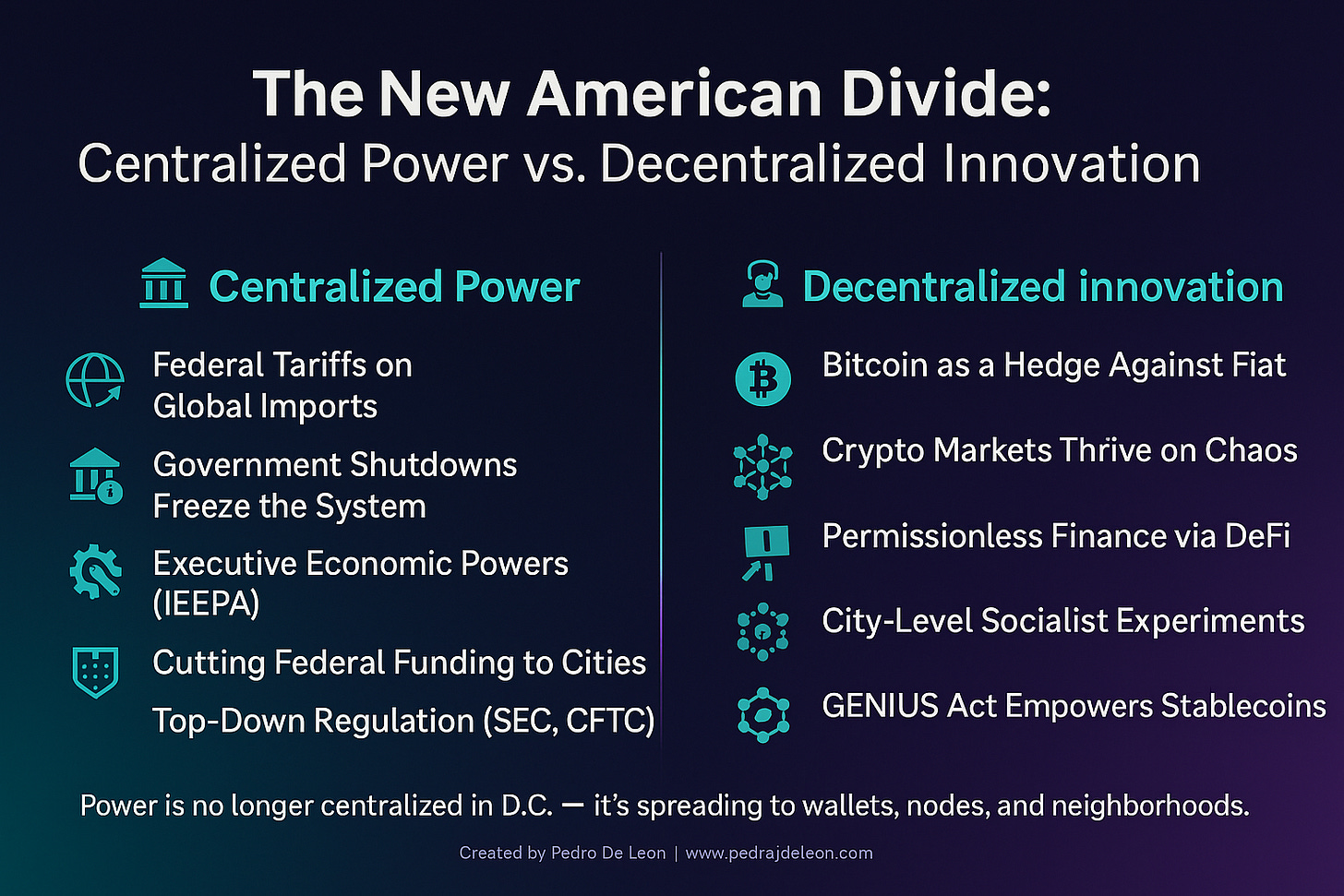

A new ideological war is unfolding: centralized government power vs. decentralized innovation. With sweeping tariffs, prolonged shutdowns, and the rise of local political disruptors, the American experiment is once again redefining itself—in crypto, in cities, and on the global stage.

🚨 America on the Brink: Power Struggles Define Our Era

We’re living in a pressure cooker moment. Historic federal shutdowns, headline-grabbing tariffs, crypto market chaos, and ideological tremors in America’s biggest cities—this isn’t business as usual. It’s a systemic test of centralized governance versus decentralized alternatives.

From the executive branch flexing emergency economic powers to digital currencies acting as safe havens from political dysfunction, the old guard and the new wave are locked in open confrontation.

Let’s break down how tariffs, shutdowns, and grassroots political revolutions are redrawing the battle lines in America’s future.

1. 🔒 Tariffs & Trade Wars: Centralized Economic Muscle or Political Theater?

The Trump administration’s trade doctrine is nothing short of audacious. Citing threats to national economic stability, the White House invoked the International Emergency Economic Powers Act (IEEPA) to slap a sweeping 10% tariff on all imports—no exceptions, no apologies.

Key Goals of This Tariff Shockwave:

Level the playing field in global trade

Push back against currency manipulation (hello, China)

Incentivize U.S. domestic production

Sounds bold. But is it sustainable?

💣 Blowback in Real Time

Inflation Pressure: Tariffs increase the cost of imports. Consumers absorb that cost, whether they’re buying electronics from Taiwan or steel from Brazil.

Supply Chain Squeeze: Small and mid-sized businesses face uncertainty as global suppliers pull back or raise prices.

Market Confusion: Unpredictable tweet-diplomacy and executive orders create a volatile environment that scares off institutional investors.

Yet, not everyone sees doom.

📈 The Case for Economic Nationalism

According to a 2024 CEA study on Trump’s first-term tariffs, the net price increases were marginal, while U.S. manufacturing output ticked up and trade deficits narrowed. Wall Street remains cautiously bullish on financials, defense, energy, and industrials that stand to benefit from protectionist policy.

But let’s be real—this is a centralized hammer being swung in a complex global market. And centralized hammers often miss the finer details.

2. ₿ Crypto’s Wild Ride: Chaos Hedge or Freedom Tech?

If you’re looking for a real-time barometer of public trust in government, just check the Bitcoin chart.

The 41-day federal shutdown (as of November 10, 2025)—the longest in U.S. history—was triggered by disputes over health subsidies and discretionary spending. The shutdown not only froze government operations but also crippled regulatory bodies like the SEC, delaying key crypto approvals and freezing ETF markets.

🔥 Crypto Responds to Political Instability

Shutdown Bounce: Bitcoin spiked 3% after news broke of a deal in Congress. Investors clearly remember the 2019 shutdown that triggered a five-month, +300% crypto bull run.

Tariff Meltdown: When Trump threatened a 100% tariff on all Chinese imports, Bitcoin crashed nearly 15% in a flash event, triggered in part by dormant bots and thin liquidity—both consequences of the shutdown.

🧠 Ideological Shift: Why Conservatives Love Crypto Now

Crypto has moved from fringe tech to ideological rallying cry for liberty-minded thinkers and investors. Here’s why:

It’s decentralized, resistant to monetary manipulation.

It’s a hedge against fiat inflation.

It’s permissionless, giving power back to individuals—not institutions.

The administration is all-in:

GENIUS Act: Landmark law giving stablecoins regulatory clarity while encouraging U.S.-based innovation.

Trump Media & Bitcoin Holdings: Over $2 billion parked in BTC and BTC securities. A deliberate move to exit legacy finance.

J.D. Vance: The incoming VP is not only a Bitcoin holder but also an outspoken supporter of the industry’s regulatory autonomy.

This is more than economics—it’s philosophy by way of fintech.

3. 🗽 NYC’s Democratic Socialist Revolution: Decentralization from the Left

While federal conservatives are championing decentralization through Bitcoin, the American Left is experimenting with it in the political arena. The landslide election of Zohran Mamdani as New York City mayor in 2025 is a watershed moment.

His platform is unapologetically socialist:

Municipal ownership of grocery stores

Massive public housing investments

Rent freezes and wealth taxes

Universal child care funded through progressive taxation

🤝 Bottom-Up Governance vs. Top-Down Sabotage

Mamdani’s model pits local sovereignty against federal antagonism:

Trump’s administration has threatened to cut NYC federal funding, challenging the financial viability of Mamdani’s policies.

GOP governors are mocking the city’s shift, with Texas Gov. Abbott joking about a “100% tariff on New Yorkers” moving to the Lone Star State.

Critics frame Mamdani as the face of an emerging “Red-Green” alliance—melding Marxist economics with post-colonial cultural critiques.

Regardless of your politics, one thing is clear: the center isn’t holding. Power is bleeding outward—into city halls, wallets, and blockchains.

🧭 Where Do We Go From Here?

This isn’t just a tug-of-war between left and right. It’s centralized vs. decentralized. Top-down mandates vs. grassroots action. Fiat control vs. cryptographic autonomy.

Centralized PowerDecentralized AlternativesFederal tariffs, emergency powers, shutdownsCrypto networks, local governance, community-led platformsSEC regulation and legacy financePermissionless DeFi and Bitcoin treasuriesNational parties dictating policyCity governments pioneering radical experiments

🎯 Key Takeaways

Tariffs signal economic nationalism, but at the cost of inflation and market uncertainty.

Crypto has become a safe haven, not just for tech enthusiasts but for those betting against government overreach.

Local politics are becoming hotbeds of ideological experimentation, from socialist initiatives to libertarian defenses of sovereignty.

Final Thought: Is This the Decade That Breaks the Mold?

The old frameworks are fraying. Institutions once seen as permanent—central banks, national parties, even fiat currency—are being questioned, hacked, or replaced. In their place? A patchwork of solutions: blockchains, local governance, and direct action.

Whether you see this moment as a crisis or an opportunity depends on where you sit.

But one thing’s for sure: the decentralized future is no longer coming—it’s already here.

Want more commentary on politics, crypto, and emerging trends?

👉 Subscribe to my newsletter or drop your thoughts in the comments—debate welcomed.